Diamonds are among the most complex commodities to price, and their valuation involves far more than a simple assessment of size or beauty. Unlike gold, which is priced based on weight and market demand, diamonds are unique gemstones, and their pricing formulas are influenced by a variety of factors. Retailers use a combination of industry-standard pricing guides, supply chain costs, and subjective market forces to determine final values. The process is not always transparent, which can make it difficult for consumers to understand why two seemingly similar stones may carry very different price tags. By exploring the methods and formulas retailers use, one can gain a clearer picture of how value is calculated, as well as the role of global benchmarks like the Rapaport Diamond Report, wholesale margins, and brand premiums in shaping final retail prices.

The Role of the 4Cs in Diamond Pricing

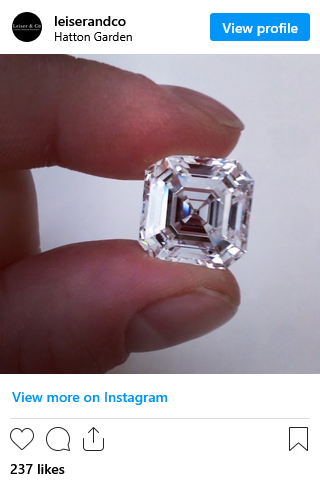

At the core of every pricing formula are the well-known 4Cs: carat weight, cut, color, and clarity. Retailers often begin their valuation by assessing these four characteristics, which are universally recognized in the diamond trade. Carat weight has a significant impact because larger diamonds are rarer and thus priced disproportionately higher per carat. Cut determines how effectively a stone reflects light, with well-cut diamonds commanding premiums. Color ranges from colorless to noticeable yellow or brown hues, with near-colorless stones generally considered more valuable. Clarity reflects the presence of inclusions or blemishes, with higher clarity stones being rarer and more expensive. Retailers typically reference grading reports from laboratories such as GIA or IGI to confirm these characteristics, which are then matched against pricing charts to establish a baseline value. However, the 4Cs alone do not account for all aspects of pricing, and other economic and psychological factors also influence how a diamond is ultimately valued in retail markets.

The Rapaport Diamond Report and Its Influence

One of the most important tools in diamond pricing is the Rapaport Diamond Report, often referred to simply as the “Rap List.” This industry-standard price list, updated weekly, provides wholesale price benchmarks for diamonds based on size, color, and clarity combinations. Retailers and wholesalers worldwide use this list as a starting point to negotiate transactions, with prices quoted per carat. However, the Rapaport list does not dictate final retail pricing; instead, it serves as a guide that establishes general market expectations. Retailers typically adjust the baseline prices up or down depending on demand, stone quality beyond the 4Cs, and competitive pressures. Some critics argue that the Rapaport list can exaggerate price fluctuations and create artificial benchmarks, but its influence remains undeniable. It provides retailers with a structured framework for pricing formulas and allows consumers, if they are aware of its existence, to better understand the hidden logic behind diamond valuations.

Markups and Retailer Margins

Another important component of diamond pricing formulas is the retailer’s markup. Once a diamond is purchased from a wholesaler, retailers add margins to cover overhead costs, branding expenses, and profit expectations. Markups vary widely depending on the type of store. For instance, large chain jewelry retailers may impose higher markups because of their extensive marketing, prime retail locations, and brand recognition. In contrast, independent jewelers or online retailers may offer lower markups, sometimes as little as 10–20% above wholesale prices, to remain competitive. Luxury brands often charge a premium that significantly exceeds standard margins, positioning diamonds as exclusive lifestyle products rather than commodities. These margins are not uniform and can differ based on economic conditions, seasonal demand, or even the retailer’s business model. Consumers often overlook this aspect, but understanding markups provides critical insight into why the same diamond can cost significantly more depending on where it is purchased.

Additional Factors Beyond the 4Cs

While the 4Cs establish the primary framework for valuation, other subtler factors often influence how retailers calculate prices. For example, diamond fluorescence, or the tendency of some stones to emit a glow under ultraviolet light, can lower or raise value depending on consumer preference and the degree of fluorescence present. Market trends also play a role, as certain shapes—such as round brilliant cuts—tend to command higher premiums due to their popularity and brilliance, while less common shapes may be priced lower despite similar 4C qualities. Certification from reputable gemological laboratories adds credibility and can increase a diamond’s value compared to uncertified stones, even when all other qualities are equal. Geographic demand can also shift pricing; for instance, markets in Asia may prefer particular cuts or color grades, leading retailers to adjust their formulas accordingly. These additional elements demonstrate that diamond pricing is not an exact science but rather a blend of quantifiable characteristics and market-driven considerations.

Supply Chain Costs and Their Impact on Pricing

The journey of a diamond from mine to market involves multiple stages, each contributing to its final retail price. Mining companies extract rough stones and sell them to cutters and polishers, who transform the diamonds into polished gems. From there, wholesalers distribute the stones to retailers. Each stage adds a layer of cost, including mining expenses, labor, cutting precision, transportation, insurance, and import duties. These costs are built into retailer formulas, ensuring that every intermediary is compensated for their role in the supply chain. For consumers, this means that the final retail price reflects not just the intrinsic qualities of the diamond but also the cumulative expenses incurred throughout the distribution network. Larger retailers with direct access to suppliers may bypass some intermediaries, lowering costs, while smaller jewelers may face higher purchase prices due to limited bargaining power. This intricate supply chain explains why diamond pricing is more complex than it may appear to the casual buyer.

The Role of Branding in Diamond Valuation

Branding has a profound effect on how retailers calculate diamond prices, often extending beyond the objective qualities of the stone. Well-known luxury brands are able to command significantly higher prices because consumers associate their names with prestige, heritage, and trustworthiness. A diamond from a renowned jewelry house may cost substantially more than an identical stone sold by an independent retailer, even if both have the same grading report. This phenomenon highlights how psychological and emotional factors are incorporated into pricing formulas. Retailers often build these premiums into their pricing strategies to reflect the intangible value of reputation and exclusivity. Marketing campaigns, celebrity endorsements, and the cultural significance of diamond jewelry, such as engagement rings, further enhance perceived value. In this sense, brand-driven pricing demonstrates that the retail cost of a diamond is not determined solely by measurable attributes but also by the power of consumer perception.

Online vs. Offline Pricing Strategies

The rise of online diamond retailers has introduced new dynamics into pricing formulas. Online sellers typically operate with lower overhead costs since they do not need to maintain physical showrooms or employ as many staff members. As a result, they can often offer diamonds at prices closer to wholesale, sometimes with margins as low as 5–15%. Brick-and-mortar retailers, on the other hand, must factor in rent, staff wages, and in-store experience, which drive up costs and, therefore, final prices. However, offline retailers argue that they provide additional value through personalized service, hands-on inspections, and the reassurance of buying from a physical store. This contrast has created a more competitive market, where consumers weigh convenience and price against trust and experience. Retailers in both spaces adapt their pricing formulas to emphasize their strengths, with online platforms focusing on transparency and affordability, while offline stores highlight service quality and brand prestige.

Psychological Pricing and Consumer Perception

Retailers also rely on psychological pricing tactics to influence consumer behavior. For example, a diamond priced at $4,995 may appear significantly less expensive than one at $5,000, even though the difference is minimal. Another common strategy involves emphasizing discounts, where a retailer may first list a diamond at an inflated “original” price before applying a visible reduction to create the perception of value. Additionally, retailers often present consumers with tiered options, such as three diamonds of varying qualities and prices, nudging buyers toward the middle choice as the most “reasonable.” These strategies are designed to enhance consumer confidence in their purchase while maximizing retailer margins. Psychological pricing demonstrates that consumer perception is as important as objective valuation in determining final retail prices. In practice, this means that formulas incorporate not only the stone’s measurable qualities but also the retailer’s understanding of consumer psychology.

The Future of Diamond Valuation

Looking ahead, the methods retailers use to calculate diamond value are likely to evolve as consumer preferences shift and technology advances. Increasing transparency, driven by blockchain-based tracking systems, may allow consumers to see detailed breakdowns of supply chain costs, reducing the mystery surrounding pricing formulas. The rise of lab-grown diamonds also challenges traditional valuation methods, as these stones can be produced more predictably and priced more competitively. Retailers may develop new formulas that reflect ethical considerations, environmental impact, and sustainability in addition to the traditional 4Cs. Furthermore, as younger generations prioritize affordability and transparency over brand prestige, online platforms and alternative diamond options may influence how formulas are structured. Ultimately, diamond pricing is expected to move toward greater clarity and fairness, balancing the traditions of luxury jewelry with modern demands for accountability and consumer empowerment.

Conclusion

Diamond pricing formulas are complex, blending objective qualities, industry benchmarks, supply chain dynamics, and consumer psychology. While the 4Cs remain the foundation of valuation, other factors such as the Rapaport Report, retailer margins, branding, and even subtle details like fluorescence or shape all contribute to the final price. Retailers further incorporate supply chain costs and branding premiums, and they adapt strategies to match consumer expectations in both online and offline marketplaces. Psychological pricing and evolving consumer demand highlight the importance of perception in shaping value. As technology and transparency tools develop, the future of diamond valuation may become more predictable, fair, and accessible, offering consumers clearer insights into the real cost of their diamonds.