Understanding the Diamond Supply Chain

To understand diamond wholesaling, one must first grasp the complexity of the diamond supply chain. The process begins at the mining stage, where rough diamonds are extracted from the earth via industrial operations in regions such as Botswana, Russia, Canada, and Australia. These rough stones are then sorted and sold by mining companies—often through tightly regulated tenders or to long-term clients called “sightholders”—before being sent to cutting and polishing centers, most notably in India, Belgium, and Israel. After cutting and grading, diamonds enter the wholesale market, where dealers purchase large quantities to distribute to retailers or manufacturers. This intricate journey affects not only pricing but also availability, quality control, and market dynamics. Wholesalers serve as the linchpin between suppliers and retailers, often handling logistics, certification, and inventory risk, making their role indispensable in the global diamond economy.

Who Are Diamond Wholesalers?

Diamond wholesalers are professionals or companies that purchase diamonds in bulk—either rough or polished—with the intention of reselling them at a markup to retailers, jewelers, or even other intermediaries. Unlike retailers who deal directly with consumers, wholesalers operate in a business-to-business (B2B) framework, providing diamonds in volume at lower per-unit prices. Their clients may include independent jewelry stores, national chains, custom jewelry designers, or online platforms. Wholesalers typically maintain extensive inventories across various qualities, carat weights, shapes, and certifications to meet diverse client needs. Because they buy in large quantities and often build long-standing relationships with diamond producers or cutters, wholesalers can leverage economies of scale and negotiate more favorable pricing. However, their success hinges on expertise in grading, authentication, market trends, and networking within tightly-knit industry circles.

Entry Barriers and Industry Gatekeeping

Entering the diamond wholesaling business is not as simple as acquiring a few stones and seeking out buyers. The industry is characterized by significant entry barriers that serve as a form of gatekeeping. For one, substantial capital investment is required to build an initial inventory, often amounting to hundreds of thousands or even millions of dollars. Additionally, trust and reputation are vital. Many transactions occur within a closed network of known dealers, and business is often conducted on handshake agreements, especially in established diamond hubs. This makes it challenging for newcomers to gain traction without personal introductions or industry references. Furthermore, knowledge of diamond grading, market fluctuations, and international trade laws is non-negotiable. Regulatory compliance with entities such as the Kimberley Process (for conflict-free sourcing) and customs authorities adds additional complexity. As such, breaking into the trade often requires mentorship, apprenticeships, or family connections within the business.

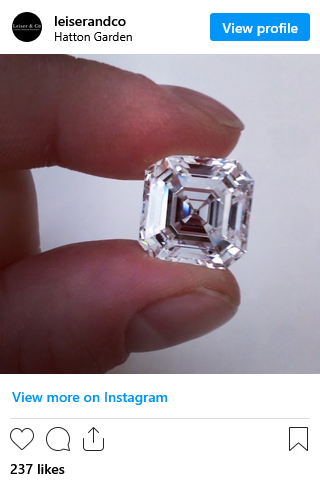

The Importance of Certification and Grading

In diamond wholesaling, certification and accurate grading are essential components of trust and valuation. Most wholesalers rely on gemological laboratories like the Gemological Institute of America (GIA), the International Gemological Institute (IGI), or the American Gem Society (AGS) to provide independent verification of a diamond’s quality. A grading report outlines the “Four Cs”—carat weight, color, clarity, and cut—and may include other details like fluorescence, symmetry, and proportions. For wholesalers, these reports help standardize value, enabling buyers to make informed decisions based on documented attributes rather than subjective assessments. Since diamonds with identical appearances can vary significantly in value depending on microscopic inclusions or color gradation, accurate grading protects both the wholesaler and their clients. Additionally, in international trade, certificates also serve a legal function by streamlining customs processes and ensuring compliance with ethical sourcing guidelines.

Pricing Strategies and Margin Dynamics

Pricing in diamond wholesaling is both an art and a science. Unlike retail prices that often include significant markups to cover marketing and overhead, wholesale prices are driven by more technical variables such as Rapaport pricing, inventory turnover, and demand cycles. The Rapaport Diamond Report serves as a pricing benchmark within the trade, although actual transaction prices often deviate based on quality and negotiation. Wholesalers must calculate margins carefully, balancing the need for competitive pricing with profitability. Margins can vary from as low as 1-2% on high-volume, lower-grade goods to 10-15% or more on specialty stones or custom orders. Timing is crucial; purchasing when prices dip and selling during high demand periods (such as holiday seasons or wedding seasons) can make a significant difference. Additionally, some wholesalers offer memo (consignment) arrangements to retailers, which can boost sales opportunities but also increase exposure to unsold inventory risk.

Global Diamond Markets and Trade Hubs

Global diamond wholesaling operates within a network of established trade hubs that specialize in either polished or rough diamonds. Key polished diamond markets include Antwerp, Mumbai, Tel Aviv, New York, and Hong Kong—each known for different aspects of the trade. For instance, Antwerp is famous for its long-established diamond bourse system and strict regulatory environment, while Mumbai handles a significant portion of the world’s diamond cutting and polishing, making it a hotspot for both manufacturing and distribution. Meanwhile, Dubai has rapidly emerged as a critical player, offering tax advantages and serving as a midpoint between African producers and Asian markets. These hubs are more than just locations; they function as ecosystems with bourses (diamond exchanges), grading labs, logistics providers, and legal support. Wholesalers operating in or through these markets gain access to a broader buyer base, real-time pricing trends, and specialized services that help manage compliance, transportation, and quality assurance at scale.

Digital Transformation and Online Wholesaling

Traditionally a face-to-face and relationship-driven business, diamond wholesaling has begun undergoing a digital transformation. With the rise of secure online platforms and global logistics solutions, wholesalers are increasingly adopting digital tools to expand their reach and streamline operations. Marketplaces such as RapNet and IDEX have become important for listing and sourcing certified stones with transparency in pricing and specifications. Some wholesalers now offer high-resolution imaging, 360-degree video, and AI-assisted grading verification to replicate the in-person viewing experience. Blockchain technologies are also being explored for provenance tracking, enabling digital ledgers that confirm ethical sourcing and chain of custody. Despite these advances, digital transactions in the wholesale diamond sector still require layers of verification and a foundation of trust, as the high value and tiny size of the product invite potential for fraud. Nevertheless, digital adaptation has created more equitable access to the industry and has broadened global market participation, especially for emerging buyers and sellers.

Risk Management in Diamond Wholesaling

The diamond wholesale market, while potentially lucrative, comes with significant risks that need to be proactively managed. Price volatility is a major concern, influenced by factors such as economic downturns, currency fluctuations, changes in consumer behavior, and geopolitical events. For example, a drop in Chinese consumer demand or disruptions in African mining can lead to pricing turbulence across the supply chain. Inventory risk is also substantial; holding large quantities of diamonds ties up capital and may result in losses if market values decline before sale. To mitigate these risks, wholesalers often diversify inventory by grade, size, and certification, and may engage in hedging strategies or establish credit insurance. Additionally, the risk of fraud—through misrepresented grading, synthetic diamonds passed off as natural, or stones with problematic provenance—requires due diligence, regular lab testing, and long-standing supplier vetting. Wholesalers must also navigate legal risk from international trade laws, import/export restrictions, and regulatory compliance.

Relationship Building and Negotiation Tactics

In the world of diamond wholesaling, relationships often outweigh contracts. Trust, reputation, and mutual benefit drive transactions more than any formal agreement, especially in traditional markets. Cultivating long-term partnerships with suppliers, cutters, and buyers allows wholesalers to secure better terms, exclusive deals, and early access to high-demand inventory. Networking through trade shows, industry associations, and local bourses remains essential for relationship building. Negotiation is also a critical skill—successful wholesalers understand how to leverage certifications, market data, and bulk buying power to obtain favorable pricing. However, negotiations go beyond numbers; cultural competence, punctuality, and ethical integrity play important roles in building credibility. It is not uncommon for deals to be finalized over shared meals or within tightly controlled trading rooms, where a dealer’s word still carries legal and financial weight. For newcomers, aligning with established mentors or entering the market through apprenticeships may serve as a practical gateway to trusted circles.

Future Trends and Emerging Challenges

As the diamond industry evolves, wholesalers are facing emerging challenges and opportunities that will shape the sector’s future. The increasing popularity of lab-grown diamonds is creating disruption in pricing, consumer perception, and inventory strategies. While natural diamonds remain the standard for long-term value and rarity, lab-grown alternatives are gaining traction for their ethical and environmental positioning, which may require wholesalers to diversify their offerings or redefine their marketing strategies. Sustainability and traceability are becoming core expectations, especially from younger demographics and institutional buyers. Technological innovations such as AI-assisted grading, digital marketplaces, and augmented reality product previews are likely to enhance the wholesale experience further. At the same time, economic uncertainties, changing trade regulations, and geopolitical instability—such as sanctions affecting Russian diamond exports—pose strategic risks. Successful wholesalers will need to remain agile, informed, and diversified to navigate the evolving terrain and maintain relevance in an increasingly complex market.