Understanding Diamond Clarity: Definition and Grading

Diamond clarity refers to the presence or absence of internal and external imperfections, known as inclusions and blemishes, respectively. These imperfections occur naturally during the formation process of the diamond and vary in size, location, and visibility. The Gemological Institute of America (GIA) developed a widely accepted clarity grading scale, which includes eleven clarity grades ranging from Flawless (FL) to Included (I1, I2, I3). At the top end of the scale, Flawless and Internally Flawless diamonds are completely or nearly free of any imperfections, even under 10x magnification. At the lower end, Included diamonds exhibit noticeable inclusions that may affect transparency and brilliance. This scale helps standardize clarity assessment and significantly influences the way diamonds are priced and sold in the market.

The Visual Impact of Clarity on Diamond Appearance

Clarity not only affects the technical grading of a diamond but also its visual presentation. High-clarity diamonds are typically more brilliant and transparent, which enhances their aesthetic appeal. However, the visual impact of clarity can sometimes be minimal to the naked eye. For instance, many diamonds graded as Very Slightly Included (VS1 or VS2) or even Slightly Included (SI1) can appear “eye-clean,” meaning that inclusions are not visible without magnification. In such cases, buyers may not perceive a significant difference in appearance compared to higher-clarity stones, although there may still be a noticeable price difference. This dynamic creates a tension between perceived quality and actual visibility, which can complicate consumer decisions and impact the market valuation of diamonds across clarity grades.

The Role of Clarity in Diamond Pricing Structures

Clarity is one of the “Four Cs” of diamond valuation—Cut, Color, Clarity, and Carat weight—and plays a central role in establishing a diamond’s price. Diamonds with higher clarity grades generally command higher prices, assuming all other factors are equal. For instance, a Flawless diamond may sell for a substantial premium compared to a Very Slightly Included counterpart, even if the difference in clarity is imperceptible without magnification. The rarity of higher-clarity diamonds contributes significantly to their value; only a small percentage of all mined diamonds are rated Flawless or Internally Flawless. However, clarity’s influence on pricing is not linear. As one descends the clarity scale, price differences between adjacent grades often become less pronounced, particularly below the VS and SI range, unless the inclusions affect structural integrity or light performance.

Market Demand and Consumer Perception of Clarity

Consumer demand also plays a pivotal role in how clarity impacts market value. Many buyers place a premium on clarity because it suggests a higher quality stone, even if the inclusions are not visible without a microscope. Jewelers and retailers often highlight clarity as a selling point, especially in engagement rings and high-end jewelry. However, some consumers prioritize other attributes such as carat size or cut quality over clarity. This has created a market in which certain clarity grades, particularly those that offer a balance between eye-clean appearance and reasonable pricing—such as VS2 or SI1—are highly sought after. Market trends can thus cause fluctuating premiums across clarity grades depending on buyer preferences, economic conditions, and even cultural expectations regarding perfection and prestige in luxury goods.

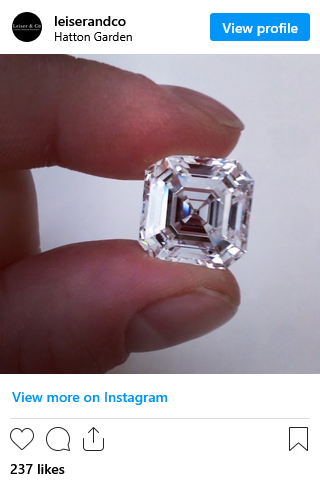

Influence of Diamond Cut on Perceived Clarity

The cut of a diamond can greatly influence how clarity characteristics are perceived. A well-cut diamond can mask minor inclusions through optimal light reflection, making them less visible even under scrutiny. Conversely, a poorly cut diamond may emphasize imperfections by diminishing light performance or causing them to be more centrally visible. Different diamond shapes and facet arrangements also affect clarity perception. For instance, step-cut diamonds like emerald and Asscher cuts tend to reveal inclusions more readily due to their broad, open facets, making clarity a more critical consideration for these shapes. On the other hand, brilliant cuts such as round or princess cuts are better at hiding inclusions due to their complex facet structures. Therefore, clarity must always be evaluated in context with cut, as these two attributes interact to influence both the diamond’s visual appeal and market valuation.

The Rarity Factor: Statistical Distribution of Clarity Grades

One of the main reasons high-clarity diamonds command a significant price premium is their scarcity. According to data from the GIA and other gemological sources, fewer than 1% of all diamonds graded annually achieve the Flawless (FL) or Internally Flawless (IF) designation. These diamonds are considered exceptional and are often sought after by collectors or investors who prioritize rarity over size or even brilliance. Very Very Slightly Included (VVS1 and VVS2) grades, while more common than FL or IF, are still rare and represent a small fraction of the diamond market. In contrast, diamonds in the VS and SI categories make up the majority of stones sold in the commercial jewelry sector. The I1 to I3 categories are typically considered lower-quality and may be used in smaller accent stones or more budget-conscious jewelry. These distribution patterns influence not only price but also the availability of certain grades in different retail or wholesale channels.

Clarity Enhancement and Its Effect on Value

The market also includes diamonds that have undergone clarity enhancement treatments to improve their visual appearance. These treatments include laser drilling to remove black inclusions, or fracture filling to make internal flaws less visible. While such enhancements can significantly improve a diamond’s appearance to the naked eye, they generally decrease the stone’s value compared to untreated diamonds with the same apparent clarity. Enhanced diamonds are typically priced lower to reflect their modified status, and gemological labs are required to disclose these treatments when issuing grading reports. From an investment or resale standpoint, enhanced diamonds are usually less desirable, and buyers may face difficulties reselling them at a competitive price. Therefore, clarity treatments create a second tier in the market that adds complexity to pricing and valuation.

Clarity’s Role in Investment Diamonds

For investors who view diamonds as alternative assets, clarity is a key variable in selecting stones with long-term value retention or appreciation potential. High-clarity diamonds—especially those certified as Flawless, Internally Flawless, or high VVS grades—are often targeted for investment purposes due to their rarity and stability in value. These stones are typically accompanied by detailed grading reports and often sold through reputable dealers or auction houses. However, clarity alone does not guarantee investment-grade status. Stones must also score high in cut, carat, and color, and ideally possess an excellent pedigree or historical provenance. Investment diamonds tend to remain relatively insulated from short-term fashion trends, but they are still subject to broader economic forces and shifts in luxury consumption patterns.

Retail vs. Wholesale: Clarity Price Differentials

There are also significant differences in how clarity affects pricing in the retail versus wholesale markets. Retail prices tend to include markups based on branding, marketing, and perceived prestige, often amplifying the value premium of high-clarity diamonds. In contrast, the wholesale market focuses more strictly on the actual gemological qualities, with narrower price spreads between clarity grades. Jewelers often purchase SI1 or SI2 diamonds wholesale and market them as “eye-clean” options that offer strong visual performance at a lower cost. This strategy allows retailers to balance consumer expectations with profitability. As a result, consumers may pay a premium for high clarity in retail contexts, while professional buyers are more likely to focus on clarity in conjunction with other metrics to determine true market value.

Future Trends in Clarity and Market Behavior

The growing popularity of lab-grown diamonds has begun to influence consumer expectations around clarity. Lab-created diamonds often achieve higher clarity grades due to the controlled manufacturing environment, and this has somewhat normalized the idea of high clarity being more accessible. However, in the natural diamond segment, clarity continues to command strong premiums, especially in the upper ranges. Additionally, technological advances in diamond imaging and grading transparency may further educate consumers, allowing for more nuanced decisions beyond simple clarity scores. In the future, clarity may remain a significant pricing factor, but its relative weight in consumer decision-making could shift depending on education, sustainability concerns, and changes in global luxury preferences.