Understanding the Diamond Market: The Foundation of Every Deal

Before any diamond transaction takes place, both the buyer and the seller must have a clear grasp of how the diamond market operates. Unlike many other commodities, diamonds do not trade on public exchanges, meaning prices are largely determined by supply and demand, private negotiations, and various subjective factors. One crucial tool in this process is the Rapaport Diamond Report, a subscription-based price list widely regarded as a benchmark in the industry. However, this list serves as a guideline rather than a fixed pricing structure. Discounts or premiums are applied based on a diamond’s quality, shape, rarity, and current market trends. Furthermore, external market forces such as geopolitical events, economic downturns, or shifts in fashion can impact pricing. Understanding these dynamics is essential for sellers to price their stones appropriately and for buyers to assess whether they are making a fair investment. Without this foundational knowledge, one or both parties may find themselves at a significant disadvantage during negotiations.

The Importance of Certification: Ensuring Trust and Transparency

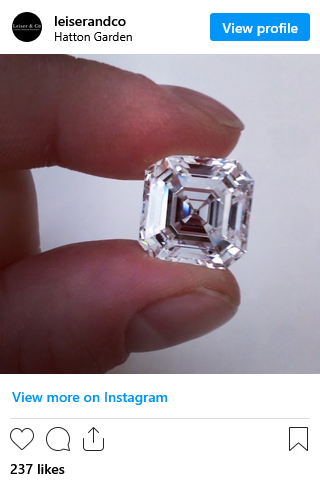

Certification plays a central role in any legitimate diamond transaction. A grading report issued by a reputable gemological laboratory, such as the Gemological Institute of America (GIA), HRD Antwerp, or International Gemological Institute (IGI), provides an objective analysis of a diamond’s key attributes—commonly known as the 4 Cs: carat weight, cut, color, and clarity. These certifications help standardize evaluations and reduce ambiguity in pricing. However, not all certificates are equal. Some labs may be more lenient in their grading, which can artificially inflate a diamond’s perceived value. Both parties should be cautious of certificates from lesser-known or lenient institutions. Additionally, buyers should cross-reference certificate numbers online to verify authenticity and confirm that the diamond has not been tampered with. Sellers, meanwhile, should be prepared to provide original documentation and may benefit from recent re-evaluations if market conditions or grading standards have shifted. In transactions involving larger or investment-grade diamonds, certificates can be the deciding factor in whether a deal proceeds.

Due Diligence: Research, Appraisals, and Legal Considerations

No diamond deal should proceed without thorough due diligence by both parties. For buyers, this means researching the seller’s credentials, reading reviews if the transaction is taking place online or via a dealer, and possibly seeking legal counsel when significant sums are involved. Buyers should also consider commissioning an independent appraisal from a certified gemologist to validate the diamond’s value and confirm that it matches the specifications stated in the certificate. Sellers, on the other hand, should ensure that their diamonds are not only properly documented but also ethically sourced, especially with rising consumer awareness regarding conflict diamonds. Providing a Kimberley Process certificate can help demonstrate compliance with international standards. Moreover, both parties must consider the legal framework governing the transaction, including return policies, tax implications, and import/export restrictions if the diamond is being traded across borders. Contracts or sales agreements should clearly state all terms, including warranties, dispute resolution mechanisms, and liability clauses to avoid misunderstandings post-sale.

Negotiation Strategies: Balancing Interests and Managing Expectations

Effective negotiation is critical to the success of any diamond deal, especially because there is often a gap between asking prices and what buyers are willing to pay. Sellers tend to anchor prices based on the Rapaport Report or previous sales, while buyers typically seek discounts—sometimes substantial ones—based on market knowledge, the liquidity of the diamond, or subjective factors such as personal taste. One proven strategy involves anchoring high but remaining flexible, particularly if the diamond has been on the market for an extended period. Conversely, buyers may gain leverage by demonstrating a solid understanding of the stone’s valuation and current market conditions. Transparency in negotiations is crucial; any attempt at misrepresentation could not only derail the deal but also damage reputations. It’s often beneficial to bring in a third-party intermediary—such as a diamond broker or consultant—who can mediate the process, especially in high-value deals. Ultimately, both parties must aim to strike a balance between value and fairness to close the deal satisfactorily.

Payment Structures and Security Measures: Protecting Both Sides

The financial aspect of a diamond deal is often the most sensitive part of the transaction, and both parties must take steps to ensure secure and verifiable payment. Depending on the size and context of the sale, payment methods can vary from cash and bank transfers to escrow services and even cryptocurrency in some international or digital transactions. For high-value deals, escrow accounts are widely recommended as they provide security by holding the buyer’s funds with a neutral third party until all agreed-upon conditions are fulfilled. This reduces the risk of fraud or breach of contract. Additionally, some transactions may require anti-money laundering (AML) compliance, especially when conducted by dealers operating under strict regulatory regimes in countries like the U.S., the U.K., or the EU. Sellers should be ready to verify their identities and document the source of the diamonds. Likewise, buyers should retain all transaction records, including invoices, certificates, and communication logs, in case of future disputes. A secure payment process not only protects the parties involved but also fosters long-term trust in the business relationship.

Logistics and Delivery: Managing the Physical Transfer of Diamonds

Delivering a diamond, especially across borders or for online transactions, involves substantial logistical considerations. Shipping high-value items like diamonds requires specialized courier services that offer insurance, real-time tracking, and secure handling. Companies such as Brinks, Malca-Amit, and FedEx Custom Critical are often utilized for this purpose. These firms are experienced in managing the risks associated with the transportation of luxury goods. It is crucial that both parties agree on the shipping method, cost responsibility, and insurance coverage before the item is dispatched. For in-person deals, arrangements may involve meeting at a jeweler’s office, a gem lab, or a secure facility. If customs are involved, proper declarations must be made to avoid seizures or penalties. Buyers should inspect the package upon arrival and verify the stone’s identity using the certificate number and possibly a jeweler’s loupe or electronic diamond tester. Delivery confirmation and chain-of-custody documentation help ensure accountability and reduce the potential for fraud or disputes after the handoff.

Post-Sale Services and Follow-Up: Building Long-Term Trust

The completion of a diamond transaction does not necessarily end the buyer-seller relationship. Reputable sellers often provide post-sale services such as resizing, cleaning, reappraisals, and resale assistance, particularly if the diamond was purchased as part of a piece of jewelry. In some cases, buyers may want to revisit the same seller to upgrade or trade in their stone, making it essential that sellers maintain accurate sales records and provide excellent customer support. Buyers may also seek insurance appraisals, which are often higher than market resale values but necessary for coverage against loss, theft, or damage. Both parties should remain accessible for follow-up communication in case any issues arise regarding certification discrepancies, delivery delays, or post-sale condition assessments. A transparent, communicative approach after the sale helps prevent legal complications and builds trust for future business opportunities. For dealers or jewelers, customer satisfaction in one transaction can lead to referrals, repeat clients, or even wholesale relationships.

Conclusion: Aligning Information, Trust, and Timing

A diamond deal is a multifaceted process requiring careful alignment of information, transparency, timing, and risk management. Both buyers and sellers must be well-prepared, informed, and protected at every stage—from price research and certification to negotiation and final delivery. While some deals may occur swiftly between experienced industry players, others may require weeks of verification, inspection, and negotiation. Regardless of the complexity, success depends on the clarity of expectations and the quality of communication. When both parties approach the transaction with professionalism and a solid understanding of industry norms, the result is not only a successful sale but also a potential gateway to long-term business partnerships or personal satisfaction. In an industry where trust and knowledge are paramount, the anatomy of a diamond deal is as much about human judgment as it is about gemological facts.