Understanding the Concept of Collateral-Based Lending

Collateral-based lending is a financial arrangement in which a borrower secures a loan by pledging an asset to the lender. This asset acts as a form of security or protection in the event of loan default. Among the various types of collateral accepted, diamond jewelry has emerged as a popular option due to its high value, compact form, and enduring market demand. Financial institutions, private lenders, and pawnshops may all accept diamond jewelry, provided it meets certain quality and documentation standards. In this context, the borrower hands over the jewelry temporarily while retaining ownership, regaining possession once the loan is repaid. If the borrower fails to repay, the lender is typically entitled to liquidate the asset to recover the outstanding debt. This form of borrowing can provide quick liquidity without the need to sell cherished or heirloom jewelry outright, making it an appealing solution for short-term cash flow needs.

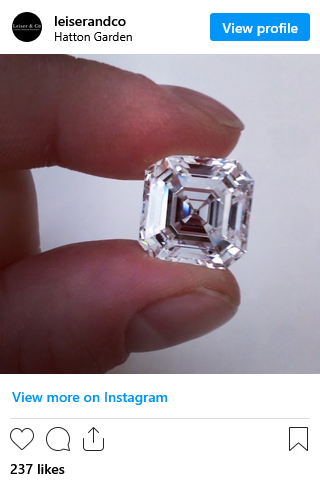

Evaluating the Suitability of Diamond Jewelry for Collateral

Before offering diamond jewelry as collateral, it is essential to evaluate whether the piece is suitable in terms of value, documentation, and condition. Not all jewelry qualifies equally; high-value pieces with recognized certification—such as those from the Gemological Institute of America (GIA)—tend to receive more favorable loan terms. Items that include clear records of purchase, appraisals from reputable gemologists, and minimal signs of wear or damage are more likely to be accepted and valued accurately. Additionally, pieces with unique characteristics such as higher carat weights, rare cuts, or branded origins (e.g., Tiffany & Co., Cartier) can command higher appraisals. Conversely, items without certificates or those with noticeable damage may be appraised at a discount. For this reason, potential borrowers are often advised to have their jewelry independently appraised before initiating the loan process, as this can serve as a benchmark when comparing offers from multiple lenders.

Types of Lenders Who Accept Diamond Jewelry as Collateral

Diamond jewelry collateral loans can be obtained from a range of lending institutions, each with its own standards, benefits, and limitations. Traditional banks typically do not offer collateral-based loans for jewelry unless it is of exceptionally high value and accompanied by comprehensive documentation. However, some private banks or wealth management firms may offer asset-backed lending to high-net-worth individuals. More commonly, borrowers turn to specialized jewelry lenders, high-end pawnshops, or online collateral loan services. These institutions are more familiar with the nuances of diamond grading and jewelry valuation, making them better equipped to offer fair and efficient loan processes. Online platforms, in particular, have grown in popularity due to their streamlined procedures, discreet service, and nationwide reach. However, they require the jewelry to be shipped for appraisal, introducing a level of risk that must be mitigated through insured shipping and clear contractual terms. Selecting the right type of lender can greatly affect not only the amount borrowed but also the interest rate and repayment flexibility.

Loan-to-Value Ratio (LTV) and How It Affects Your Loan

The Loan-to-Value ratio (LTV) is a critical factor in collateral-based lending, including when using diamond jewelry. The LTV represents the percentage of the jewelry’s appraised value that the lender is willing to loan. For instance, if a piece of jewelry is appraised at $10,000 and the LTV offered is 60%, the borrower will receive a loan of $6,000. Lenders determine LTV based on factors such as diamond quality, resale market conditions, and ease of liquidation. Most reputable lenders offer LTVs ranging from 50% to 70% for well-documented, high-quality diamond pieces. However, if the jewelry is poorly documented or hard to resell, the LTV may drop significantly. Borrowers should understand that while higher LTVs offer more immediate cash, they also increase the risk of losing the jewelry if the loan cannot be repaid on time. Additionally, some lenders may charge higher interest rates in exchange for a higher LTV, making it essential to evaluate the overall cost of borrowing—not just the upfront loan amount.

Understanding Interest Rates and Loan Terms

Interest rates and repayment terms are central components of any collateral-based loan agreement and can vary widely depending on the lender and the perceived risk. Interest rates for loans secured by diamond jewelry are generally higher than traditional bank loans due to the risk involved and the specialized nature of the collateral. Rates can range from 2% to 10% per month, translating to annualized interest rates of 24% to over 100% in some cases. The loan term typically spans from 30 days to several months, with the option to renew or extend under certain conditions. It is critical to read the fine print and understand whether the loan is structured with compound interest, prepayment penalties, or renewal fees. Failure to meet the repayment schedule can result in forfeiture of the jewelry. Therefore, borrowers should ensure they have a clear repayment strategy or a backup plan, such as refinancing or partial payments, to avoid defaulting on the loan.

The Role of Appraisal in Determining Loan Value

Appraisal plays a foundational role in determining the value of diamond jewelry offered as collateral. A professional jewelry appraisal is an expert evaluation of the item’s worth, typically conducted by certified gemologists or appraisers. The appraisal considers factors such as the diamond’s 4Cs—cut, color, clarity, and carat weight—as well as the overall craftsmanship, brand reputation, and current market trends. Lenders use this appraisal to assess the maximum amount they are willing to lend against the item. While some lenders perform their own in-house appraisals, others may accept independent appraisals provided by recognized professionals. However, even with documentation, some lenders may still undervalue the item as a precautionary measure. For borrowers, it is advisable to obtain multiple appraisals to understand the item’s potential range in value and use this information to negotiate better loan terms. Keep in mind that insurance appraisals may reflect replacement value, which is often higher than resale value, and may not be used as a basis for loan offers.

Risks Involved in Using Diamond Jewelry as Collateral

While using diamond jewelry as loan collateral can be a convenient and fast way to secure funds, it carries several important risks that borrowers must carefully consider. The primary risk is the loss of the jewelry itself. If a borrower fails to repay the loan according to the agreed terms, the lender typically has the right to liquidate the asset to recover their money. For individuals using heirloom or sentimental pieces, this could result in an irreplaceable loss. In addition to forfeiture, there is also the risk of undervaluation, where the lender’s appraisal may not accurately reflect the item’s market worth, resulting in a smaller loan than the borrower expected. Furthermore, poorly regulated or disreputable lenders may have vague or predatory terms hidden in the contract, such as exorbitant fees, unclear repayment conditions, or rapid default clauses. To minimize these risks, borrowers should thoroughly vet lenders, insist on written contracts, and ideally seek legal or financial advice before entering into any agreement.

Legal Considerations and Regulatory Compliance

Borrowers should be aware that collateral-based loans, especially those involving valuable personal property like diamond jewelry, are subject to legal regulations that vary by jurisdiction. Many countries and states require lenders to be licensed and to comply with consumer protection laws that govern interest rates, transparency, and repossession procedures. For instance, in the United States, some states cap interest rates on pawn or collateral loans, and require detailed record-keeping of appraisals, agreements, and disbursements. Furthermore, the borrower may be entitled to a grace period or the opportunity to reclaim the collateral after a missed payment, depending on the jurisdiction. It is critical to request and retain a copy of the loan agreement, which should include all terms related to loan amount, interest, duration, collateral description, default procedures, and borrower rights. Borrowers are also encouraged to ensure that the lender has adequate insurance for the item while in possession, protecting against damage, loss, or theft during the loan period.

Storage and Security of the Jewelry During the Loan Term

An often-overlooked aspect of collateral loans involving diamond jewelry is the manner in which the asset is stored during the loan term. Reputable lenders should provide secure storage, often in a bank-grade vault or other insured, climate-controlled environment, to protect the jewelry from damage, theft, or degradation. This is especially important for high-value pieces or items with delicate settings. Upon handing over the jewelry, borrowers should receive a detailed receipt that includes photographs, descriptions, and serial or certification numbers if applicable. Additionally, some lenders offer online tracking or updates, allowing the borrower to monitor the status of their collateral throughout the loan period. For online lenders, secure and insured shipping is a necessity, and the borrower should verify the logistics provider and coverage before dispatching their items. If a lender cannot demonstrate proper storage or provide documentation ensuring the item’s safety, this may be a red flag indicating a higher level of risk to the borrower.

Repayment Strategies and Loan Renewal Options

Proper financial planning is essential for successfully navigating a collateral loan secured by diamond jewelry. Borrowers should evaluate their ability to repay the loan within the specified term and consider building a repayment buffer into their personal budget to account for unexpected expenses. Some lenders allow loan renewals or extensions if the borrower is unable to meet the original deadline, though this often comes with additional fees or accrued interest. It’s also common for lenders to allow partial payments that reduce the principal, lowering the cost of interest over time. In any case, borrowers should clarify in advance whether early repayment is penalized or encouraged. For longer-term needs, it may be more cost-effective to seek refinancing or to explore traditional lending alternatives such as personal loans, especially if the cost of interest begins to outweigh the benefit of using jewelry as collateral. Transparency in financial forecasting can help preserve the jewelry and avoid unnecessary debt accumulation.

Final Thoughts: Weighing Pros and Cons

Using diamond jewelry as loan collateral can be a practical solution for those in need of quick, asset-backed financing. It offers access to capital without selling a valued possession outright and can be especially useful for short-term liquidity needs. However, this financial tool is not without its downsides. High interest rates, the risk of forfeiture, and potential exposure to unethical lenders can make it a costly choice if not handled with care. The best outcomes are achieved when borrowers approach the process well-informed, with appropriate documentation, and after comparing multiple offers. Taking the time to research the lending landscape, understand legal protections, and prepare a realistic repayment strategy can make the process smoother and safer. For those who view their diamond jewelry not just as adornment but as a dormant financial asset, collateral-based lending presents both an opportunity and a responsibility—one that should be undertaken with the same diligence as any other major financial decision.