The Concept of Liquidity in the Diamond Market

Liquidity, in financial terms, refers to how quickly and easily an asset can be converted into cash without significantly affecting its market value. In the diamond market, liquidity is a multifaceted concept influenced by factors such as demand, supply, grading standards, and resale infrastructure. Unlike commodities like gold or stocks that have well-defined market mechanisms and daily price quotes, diamonds are far less standardized. Each diamond has unique characteristics—such as carat weight, color, clarity, and cut—that impact its value and marketability. As a result, turning a diamond into cash can be a slower and more nuanced process. This illiquidity means sellers often face reduced pricing power and may need to wait for the right buyer, especially in the absence of a centralized exchange. Understanding this aspect of the market is critical for both buyers and sellers who wish to transact with confidence and avoid unrealistic expectations.

Why Diamonds Are Less Liquid Than Other Assets

Diamonds are inherently less liquid than many other investment vehicles due to their uniqueness and subjective valuation. Unlike stocks or mutual funds that are traded on regulated exchanges with transparent pricing, diamonds lack a universal pricing index. The Rapaport Price List provides a general benchmark, but real-world pricing is often negotiated and influenced by subtleties that a list cannot fully capture. In addition, there is no “spot market” for diamonds similar to those for commodities like gold, silver, or oil. This lack of standardization, coupled with the fact that buyers and sellers must individually agree on each diamond’s value, slows down transactions and reduces the ability to liquidate quickly. Moreover, transaction costs such as appraisal fees, certification charges, and commissions to brokers or jewelers further diminish overall returns and liquidity. Therefore, while diamonds may hold aesthetic and sentimental value, they should be viewed with caution as liquid financial instruments.

The Role of Diamond Certification in Enhancing Liquidity

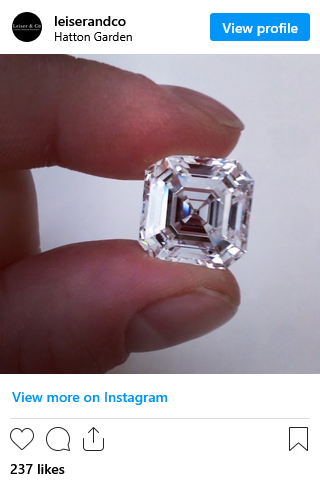

Diamond certification plays a significant role in improving the liquidity of a diamond. Certificates issued by reputable laboratories, such as the Gemological Institute of America (GIA), the International Gemological Institute (IGI), or the American Gem Society (AGS), provide an objective analysis of a diamond’s quality characteristics. These documents detail the four Cs—cut, color, clarity, and carat weight—along with additional information about fluorescence, polish, and symmetry. A certified diamond tends to inspire greater buyer confidence and fetch a more consistent price in the secondary market. Without a certificate, sellers may struggle to justify their asking price, while buyers may hesitate due to uncertainty about the gem’s authenticity or quality. However, not all certification bodies are equal; diamonds certified by lesser-known labs may suffer from inflated grading or inconsistent standards, which can erode buyer trust. To maximize liquidity, sellers are encouraged to secure certificates from internationally recognized labs that uphold strict grading criteria and impartiality.

Secondary Market Options for Selling Diamonds

The secondary market for diamonds consists of various selling channels, each with its own advantages, disadvantages, and implications for liquidity. One of the most traditional routes is through local jewelers or pawn shops. While these outlets offer convenience and immediate payment, they often provide the lowest returns because they resell at a profit margin and must assume inventory risk. Online diamond buyers and resale platforms, such as Worthy or WP Diamonds, offer a more modern approach by connecting sellers to a broader audience, often via auction or direct purchase. These platforms typically require certification and a thorough appraisal, but they may offer better prices. Consignment through a jeweler is another option, allowing the diamond to be displayed and sold to retail customers; however, this process can take months and often includes a high commission. Finally, peer-to-peer platforms and auction houses offer further alternatives but require more effort, negotiation, and patience. Each of these channels presents different trade-offs between speed, price, and effort.

Factors That Influence a Diamond’s Resale Value

Numerous factors influence the resale value of a diamond, making it a complex asset to evaluate. The most significant determinants include the four Cs—carat, cut, clarity, and color. Larger diamonds with higher clarity and excellent cuts typically retain more value and are easier to sell. However, even within identical grading ranges, two diamonds may be valued differently due to factors such as fluorescence, symmetry, or market trends. Market conditions also play a crucial role; during economic downturns or times of decreased consumer spending, diamond demand may decline, lowering resale values. Furthermore, fashion trends can shift preferences toward certain cuts or sizes, affecting demand for specific stones. Another key consideration is brand affiliation; diamonds from luxury brands like Tiffany & Co. or Cartier may command higher resale values. Additionally, whether the diamond is set in a piece of jewelry or loose can impact its appeal and liquidity, as many buyers prefer loose stones for customization purposes. Understanding these variables helps sellers set realistic price expectations and choose appropriate sales strategies.

How Buyers Can Navigate Diamond Liquidity with Confidence

For buyers, understanding diamond liquidity is essential not only from an investment perspective but also for future resale opportunities. While most consumers purchase diamonds for emotional or symbolic reasons—such as engagements or anniversaries—some may also consider their resale potential. To navigate the market with confidence, buyers should prioritize transparency and documentation. Purchasing certified diamonds from reputable dealers reduces the risk of overpaying and ensures that the stone can be resold more easily in the future. Buyers should also request laser inscriptions on the girdle, which tie the stone to its certificate and deter fraud. Moreover, buyers might consider sticking to diamonds with characteristics that appeal to a broader market—such as round brilliant cuts in the 1 to 2 carat range with G-H color and VS2-SI1 clarity—since these tend to have stronger demand in the resale market. Understanding these factors allows buyers to make informed choices that not only meet their aesthetic preferences but also retain reasonable liquidity if resale becomes necessary.

Strategies to Maximize Liquidity When Selling

Sellers looking to maximize liquidity and return on their diamonds must approach the process strategically. First and foremost, having a recent certification from a reputable gemological laboratory is essential. If a diamond was graded many years ago, consider having it re-certified, as up-to-date documentation increases buyer confidence. Sellers should also invest time in researching the most appropriate resale channel. For instance, if speed is a priority, online diamond buying services might be preferable, even if the return is slightly lower. On the other hand, if maximizing price is more important than speed, consignment or auction platforms might yield better results. Effective presentation—such as professional photography or polished settings—can also enhance perceived value. Additionally, being flexible and realistic with pricing based on current market conditions is vital. Overpricing can result in long delays or no sale at all. By combining thorough preparation, realistic expectations, and careful platform selection, sellers can significantly improve their chances of achieving liquidity.

The Impact of Economic Cycles on Diamond Liquidity

Economic cycles play a major role in the liquidity of luxury assets like diamonds. During periods of economic growth, increased consumer confidence and discretionary income typically boost the demand for luxury goods, including diamond jewelry. As a result, sellers may find it easier to liquidate their stones at favorable prices. Conversely, during recessions or financial uncertainty, consumers and investors tend to shift their spending toward essentials or liquid assets like cash, bonds, or gold. In such periods, the demand for diamonds declines, and their liquidity decreases significantly. It may take longer to find buyers, and those who are buying may offer lower prices due to perceived risk or decreased competition. Additionally, currency fluctuations, interest rate changes, and inflation can indirectly influence diamond prices and liquidity. Understanding these macroeconomic trends can help both buyers and sellers time their transactions more effectively. Timing the market, while never foolproof, can sometimes yield better outcomes for those looking to buy low or sell high.

Comparing Liquidity: Diamonds vs. Other Tangible Assets

When evaluating diamonds in terms of liquidity, it is useful to compare them with other tangible assets such as gold, real estate, fine art, and collectibles. Gold stands out as one of the most liquid tangible assets due to its fungibility, standardized pricing, and broad global market. It can be sold quickly almost anywhere in the world at transparent prices. Real estate, while often appreciating in value, is relatively illiquid due to high transaction costs, legal processes, and time-consuming sales. Fine art and collectibles can also be illiquid, with their values subject to subjective interpretation and niche demand. Diamonds fall somewhere in the middle: less liquid than gold but arguably more liquid than niche collectibles. Their liquidity is influenced by quality, certification, and current demand trends, making them a complex asset class to manage. For individuals seeking both emotional and investment value, understanding where diamonds fall on the liquidity spectrum can guide more balanced financial decisions.

The Role of Technology and Innovation in Improving Diamond Liquidity

Technological advancements are beginning to improve diamond liquidity, offering more transparent, efficient, and accessible platforms for buying and selling. Online marketplaces and auction platforms now enable global reach, expanding the pool of potential buyers and speeding up transactions. Blockchain technology is also being explored for diamond provenance and tracking, offering immutable records that can enhance trust and reduce fraud. Digital grading reports and AI-assisted pricing tools allow for more objective and real-time valuation of diamonds, reducing the knowledge gap between professionals and consumers. Additionally, mobile apps and comparison tools empower both buyers and sellers to access market data, estimate resale values, and transact with confidence. These innovations are slowly addressing some of the structural barriers that have historically made diamonds illiquid. While technology will not completely eliminate the complexity of diamond valuation, it does offer practical tools that help market participants make smarter, faster, and more informed decisions.