Introduction: The Evolving Diamond Landscape

Over the last two decades, the global diamond industry has undergone a profound transformation, driven largely by advances in technology, shifting consumer values, and changing market dynamics. Traditionally, natural diamonds dominated the jewelry market, with their origin stories of geological formation under extreme pressure adding to their mystique and perceived value. However, the rise of synthetic—or lab-grown—diamonds has begun to disrupt this centuries-old narrative. Unlike imitation stones such as cubic zirconia or moissanite, synthetic diamonds are chemically and physically identical to their natural counterparts. As a result, they’ve gained considerable traction among both consumers and industry professionals, especially as environmental and ethical considerations come to the forefront of purchasing decisions. This article explores the market trends and consumer preferences shaping the evolving competition between synthetic and natural diamonds.

Understanding the Differences Between Synthetic and Natural Diamonds

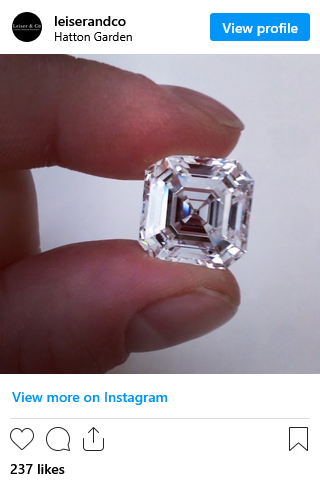

At a molecular level, synthetic diamonds are composed of the same carbon atom structures as natural diamonds, giving them identical hardness, brilliance, and refractive properties. The main difference lies in their origin: natural diamonds are formed deep within the Earth’s mantle over billions of years, while synthetic diamonds are created in laboratories using advanced techniques like High Pressure High Temperature (HPHT) or Chemical Vapor Deposition (CVD). These lab-grown methods simulate the natural conditions under which diamonds form but accomplish the process in a matter of weeks. Visually, synthetic diamonds are virtually indistinguishable from natural ones, requiring advanced gemological equipment to differentiate between the two. Despite their similarities, synthetic and natural diamonds diverge sharply in terms of pricing, availability, perceived prestige, and environmental footprint, all of which impact how the market and consumers respond to them.

Market Share and Growth of Synthetic Diamonds

Synthetic diamonds have experienced explosive market growth in recent years, particularly since 2018 when the U.S. Federal Trade Commission revised its guidelines to officially define lab-grown diamonds as “real” diamonds. By 2023, synthetic diamonds accounted for an estimated 10% to 15% of the global diamond jewelry market, with projections suggesting continued double-digit annual growth. Major players like De Beers, once solely a natural diamond proponent, launched their own lab-grown diamond brand, Lightbox, signaling a significant shift in industry acceptance. The affordability of synthetic diamonds—typically 30% to 50% less expensive than natural diamonds—has widened their appeal, especially among younger demographics and budget-conscious consumers. Additionally, advances in production efficiency and marketing have made synthetic diamonds more visible in mainstream retail channels, contributing further to their rising share of the global diamond market.

Price Trends and Economic Factors

One of the most significant differentiators between synthetic and natural diamonds lies in their pricing and resale value. As synthetic diamond production becomes more efficient and scalable, the market has seen a steady decline in lab-grown diamond prices, particularly in the 1 to 3 carat range. This commoditization effect benefits consumers in terms of affordability but raises concerns about long-term value retention. Natural diamonds, by contrast, tend to retain higher resale value due to their rarity, legacy status, and more established second-hand market. However, even the pricing of natural diamonds has faced volatility due to oversupply, geopolitical disruptions, and shifting luxury spending habits. Macroeconomic conditions, such as inflation, consumer sentiment, and raw material supply chains, also play a critical role in shaping the comparative pricing dynamics between these two types of diamonds.

Environmental and Ethical Considerations

The ethical and environmental implications of diamond sourcing have become increasingly important to modern consumers. Natural diamonds, particularly those extracted from large-scale open-pit mines, have faced criticism for their ecological impact, which includes habitat destruction, water consumption, and carbon emissions. Moreover, concerns over human rights violations in conflict zones have tainted the perception of certain natural diamonds, despite regulatory frameworks like the Kimberley Process. Synthetic diamonds, in contrast, are often marketed as the ethical and eco-friendly alternative, as they do not involve mining and can be produced using renewable energy. However, not all lab-grown diamonds are created equally—some still rely heavily on fossil fuels, especially in countries with less stringent energy standards. This complexity has sparked debates about greenwashing in the industry and has pushed certification bodies to develop sustainability benchmarks for both synthetic and natural diamonds.

Shifts in Consumer Demographics and Preferences

Consumer attitudes toward diamonds have shifted significantly in the 21st century, with generational values playing a pivotal role. Millennials and Gen Z, who collectively represent a growing share of global luxury spending, are particularly drawn to transparency, sustainability, and affordability in their purchasing decisions. Surveys indicate that younger buyers are more open to lab-grown diamonds, viewing them as ethical and modern alternatives to natural stones. In contrast, older generations often continue to favor natural diamonds, valuing their traditional prestige and rarity. Cultural influences also play a role; for instance, in markets like India and China—where diamonds often symbolize familial status and long-term investment—natural diamonds still command higher regard. Nevertheless, the global accessibility of synthetic diamonds through online platforms and the messaging around ethical sourcing have begun to erode longstanding biases, especially in urban, Western, and tech-savvy consumer bases.

Branding, Certification, and Marketing Strategies

Marketing and branding have become essential tools for shaping consumer perception in the diamond industry, particularly as the physical differences between synthetic and natural diamonds are negligible. Natural diamond brands often emphasize legacy, heritage, and emotional storytelling, highlighting the billions of years required for these gems to form and their passage through history. Certification bodies like GIA (Gemological Institute of America) and IGI (International Gemological Institute) provide detailed grading reports that reinforce authenticity and quality assurance. Lab-grown diamond sellers, by contrast, focus on innovation, affordability, and environmental responsibility. They often promote the technological marvel of diamond creation and the reduced ecological impact. However, one challenge synthetic diamond companies face is ensuring clarity in labeling; failure to disclose a stone’s origin can damage brand trust. As a result, transparent certification and honest marketing have become vital in earning consumer confidence on both sides of the market.

Investment Potential and Resale Market Differences

The investment profiles of synthetic and natural diamonds diverge markedly, influencing how consumers approach long-term ownership. Natural diamonds have traditionally been considered a form of wealth preservation, especially high-quality stones with rare characteristics. Auction houses and estate sales often include natural diamonds as part of legacy assets, underlining their perceived value and collectibility. In contrast, synthetic diamonds currently have a limited resale market, with most buyers viewing them as consumer goods rather than investment vehicles. This difference is also reflected in insurance valuations and financial instruments tied to the gem market. Although some proponents argue that lab-grown diamonds could develop secondary markets as acceptance grows, this process is still in its early stages. Until broader market mechanisms and buyer interest emerge, synthetic diamonds remain largely a purchase driven by aesthetics and values rather than financial appreciation.

Industry Outlook and Technological Innovation

Looking forward, technological innovation will likely continue to drive the lab-grown diamond segment, enhancing production capabilities, reducing costs, and allowing for more customization. Developments in plasma reactors, energy efficiency, and carbon capture integration may further reduce the environmental footprint of synthetic diamond production. Simultaneously, the natural diamond industry is responding with increased efforts to trace and certify the provenance of stones, leveraging blockchain technology and sustainability pledges. Both sectors are also experimenting with hybrid strategies—such as jewelers offering both synthetic and natural options in the same collection—to appeal to a broader customer base. Market analysts predict that the diamond industry will remain bifurcated but that consumer education, price sensitivity, and ethical considerations will increasingly determine the dominant segment in various regions. Flexibility, authenticity, and trust will be the key factors defining the next era of growth in both synthetic and natural diamond markets.

Conclusion: Coexistence or Competition?

Rather than being in direct competition, synthetic and natural diamonds may evolve to serve different roles within the jewelry and luxury markets. While natural diamonds continue to embody tradition, exclusivity, and long-term value, synthetic diamonds cater to a new generation focused on innovation, affordability, and ethics. Both segments offer compelling narratives that resonate with different consumer priorities. The future of the diamond industry may not hinge on one category overtaking the other but on how each adapts to consumer demands, global regulation, and technological change. Retailers, manufacturers, and certification bodies that recognize this duality and invest in transparency, education, and diversification are likely to find the most success. Ultimately, consumer choice will dictate the pace and direction of the diamond market’s transformation, with preference increasingly shaped by values as much as by visual appeal.