Diamonds have long been associated with luxury, wealth, and status, but they are increasingly being viewed as an alternative form of investment. While traditionally, assets like stocks, bonds, and real estate have been more common choices for investors, diamonds offer a tangible and portable asset that can appreciate in value over time. However, investing in diamonds is not as straightforward as investing in gold or other commodities. It requires a keen understanding of the market, the factors that determine a diamond’s value, and the risks involved.

In this comprehensive guide, we will explore the key considerations for beginners looking to invest in diamonds. From understanding the 4Cs and the importance of certification to evaluating potential returns and market trends, this article will provide detailed insights to help you make informed decisions.

Why Invest in Diamonds?

Diamonds are often seen as a stable investment, especially during times of economic uncertainty. Unlike stocks or currencies, diamonds are a physical asset that is not subject to the same level of market volatility. They are also durable and portable, making them easy to store and transport. Moreover, the finite supply of natural diamonds, along with increasing global demand, particularly from emerging markets, contributes to their long-term value appreciation.

Some reasons why people consider diamonds as an investment include:

- Hedge Against Inflation: Diamonds can serve as a store of value, protecting wealth against inflation or currency devaluation.

- Portfolio Diversification: Investing in diamonds allows for diversification, reducing exposure to the risks associated with traditional financial markets.

- Global Demand: Rising demand from emerging markets like China and India ensures that the long-term value of diamonds is likely to remain strong.

However, diamonds should not be viewed as a liquid asset. Unlike stocks or bonds, they cannot be easily traded, and their value can vary significantly based on factors like quality, size, and market trends. Investors should be prepared for a long-term commitment and should approach diamond investment with the same level of research and analysis as they would with other forms of investment.

Understanding the 4Cs: The Foundation of Diamond Value

The value of a diamond is primarily determined by the 4Cs: Carat, Cut, Color, and Clarity. These four factors form the foundation of diamond grading and directly impact the stone’s price and investment potential. For those considering diamonds as an investment, a thorough understanding of the 4Cs is essential.

1. Carat (Weight)

Carat refers to the weight of the diamond, with one carat equal to 0.2 grams. Larger diamonds are rarer and more valuable, making carat weight a significant factor in determining a diamond’s price. However, it’s important to note that diamond value does not increase linearly with carat weight. For instance, a 2-carat diamond may be worth more than twice as much as a 1-carat diamond because larger diamonds are exponentially rarer.

When investing, it is often advisable to opt for diamonds that are just below a full carat, such as 0.90 carats or 1.90 carats. These diamonds can offer better value because their price per carat is lower, while still appearing nearly as large as full-carat stones.

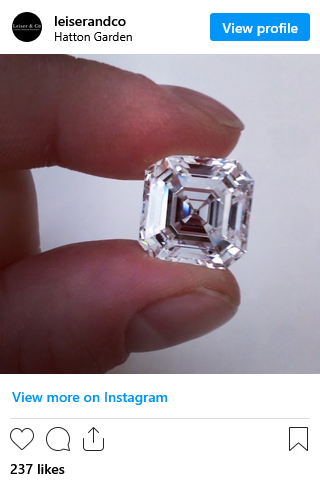

2. Cut

The cut of a diamond has the greatest impact on its overall brilliance and sparkle. While carat weight, color, and clarity are important, a well-cut diamond can outshine a larger or clearer stone with a poor cut. The cut is determined by how well the diamond’s facets interact with light. A well-cut diamond reflects light internally and externally, creating a dazzling effect that enhances its visual appeal.

The Gemological Institute of America (GIA) grades diamond cuts as Excellent, Very Good, Good, Fair, and Poor. For investment purposes, it is generally recommended to choose diamonds with an Excellent or Very Good cut, as these stones offer the best combination of beauty and value.

3. Color

Diamonds are graded on a color scale that ranges from D (completely colorless) to Z (light yellow or brown). Colorless diamonds are the rarest and therefore the most valuable. The absence of color allows the diamond to reflect light more effectively, resulting in greater brilliance.

For investment purposes, diamonds graded between D and F (colorless) or G to J (near-colorless) are often considered the best options. While diamonds with lower color grades can be more affordable, their investment potential may be lower due to reduced market demand for stones with noticeable color tints.

4. Clarity

Clarity refers to the presence of internal or external flaws, known as inclusions and blemishes, respectively. Diamonds with fewer imperfections are rarer and more valuable. The GIA grades clarity on a scale that ranges from Flawless (no inclusions or blemishes visible under 10x magnification) to Included (inclusions visible to the naked eye).

For investment purposes, diamonds with clarity grades between Flawless and VS2 (Very Slightly Included) are generally considered to offer the best value. While flawless diamonds are extremely rare and expensive, VS1 and VS2 diamonds provide an excellent balance of quality and affordability, as their inclusions are often invisible to the naked eye.

Certification: Ensuring the Authenticity and Quality of Your Investment

When investing in diamonds, certification is crucial. A certified diamond comes with a grading report from an independent, reputable laboratory, such as the GIA, the International Gemological Institute (IGI), or the American Gem Society (AGS). These reports provide detailed information about the diamond’s characteristics, including its 4Cs, fluorescence, and any treatments or enhancements it has undergone.

The GIA is widely regarded as the most reputable grading authority in the diamond industry, and its certificates are considered the gold standard. Investors should be cautious about purchasing diamonds without proper certification, as uncertified stones may be misrepresented in terms of quality, leading to a potential loss of value.

In addition to ensuring the diamond’s quality, certification also provides a level of transparency and trust. This is particularly important for resale purposes, as buyers are more likely to trust and pay a premium for certified diamonds. Certificates also make it easier to compare diamonds and their prices, helping investors make informed decisions.

Key Investment Strategies: What to Look For

To make smart choices when investing in diamonds, it’s important to adopt a strategic approach. Here are some key considerations to keep in mind:

1. Focus on Quality Over Size

While large diamonds may seem appealing, it is often better to focus on quality rather than sheer carat weight. High-quality diamonds with excellent cut, color, and clarity grades will retain their value better than larger diamonds with inferior grades. A 1-carat diamond with top-tier grades in cut, color, and clarity is likely to perform better as an investment than a 2-carat diamond with visible flaws or a poor cut.

2. Rarity and Demand

Rarity plays a major role in determining a diamond’s investment potential. Fancy color diamonds—such as pink, blue, or yellow diamonds—are extremely rare and have seen significant price appreciation in recent years. These diamonds are often sought after by collectors and high-net-worth individuals, making them a strong investment option.

Similarly, diamonds with flawless clarity, excellent cut grades, or unique provenance (such as historic or celebrity-owned stones) can command premium prices in the market. Investors should seek diamonds that stand out for their rarity and appeal to future buyers.

3. Market Trends and Timing

Like any investment, timing is important when buying diamonds. Diamond prices can fluctuate based on global economic conditions, market demand, and supply trends. For example, during times of economic uncertainty, the demand for luxury goods may decline, which can affect diamond prices. Conversely, rising wealth in emerging markets can drive up demand and prices for high-quality diamonds.

Investors should stay informed about market trends and consider working with a knowledgeable diamond dealer or investment advisor to help navigate the complexities of the diamond market. It is also important to approach diamond investment with a long-term perspective, as it may take several years for a diamond to appreciate in value.

Potential Returns: How Diamonds Appreciate in Value

One of the most critical questions for any investor is how their asset will appreciate over time. Diamond investments can offer substantial returns, but the potential for profit depends heavily on factors such as the quality of the diamond, market demand, and the rarity of the stone.

1. Long-Term Appreciation

Diamonds are often considered a long-term investment, as they tend to appreciate in value over decades rather than years. Historically, diamonds have maintained a steady appreciation rate of around 3-4% annually, though rare diamonds and fancy-colored diamonds can experience higher rates of growth.

For instance, pink and blue diamonds have seen extraordinary price increases over the past few decades. According to various market reports, the price of high-quality pink diamonds increased by approximately 400% between 2000 and 2020, while blue diamonds also experienced significant price appreciation. The increasing rarity of these stones, combined with strong demand from collectors and high-net-worth individuals, has made them some of the best-performing assets in the diamond market.

2. Supply Constraints

One factor contributing to diamond price appreciation is the finite supply of natural diamonds. Many of the world’s largest diamond mines are reaching the end of their productive lifespans, and the discovery of new diamond deposits has been limited. As supplies dwindle, the value of existing high-quality diamonds is likely to increase.

For example, the Argyle mine in Australia, which was responsible for producing over 90% of the world’s pink diamonds, closed in 2020. This has further driven up the value of pink diamonds, as they are now even rarer. Investors who own rare diamonds from mines that are no longer producing could see significant returns over time as supply diminishes and demand continues to grow.

3. Inflation Hedge

Like gold, diamonds can act as a hedge against inflation. In times of economic uncertainty, investors often turn to tangible assets like diamonds and gold as a store of value. While diamond prices may not be as directly correlated to inflation as gold, high-quality diamonds have historically retained their value during periods of currency devaluation or financial instability.

However, it’s important to note that diamonds are not as liquid as gold. They cannot be easily sold on global commodity exchanges, and their value is more subjective, depending on the specific characteristics of each stone. This makes diamonds a better long-term store of value rather than a short-term hedge against market fluctuations.

Risks and Challenges of Diamond Investment

While diamonds offer the potential for significant returns, they are not without risks. As with any investment, it’s essential to be aware of the potential downsides and challenges before committing capital to diamond purchases.

1. Illiquidity

One of the biggest challenges of investing in diamonds is their illiquidity. Unlike stocks, bonds, or even gold, diamonds cannot be easily traded on financial markets. Selling a diamond often requires finding the right buyer, which can be time-consuming. Additionally, selling through a jeweler or auction house may involve high transaction fees, which can eat into your profits.

To mitigate the risk of illiquidity, it’s crucial to invest in diamonds that have broad market appeal, such as round brilliant cuts or rare fancy-colored diamonds. These types of diamonds are more likely to attract buyers and maintain their value over time.

2. Price Volatility

While diamonds are often viewed as stable investments, their prices can still experience periods of volatility, particularly during economic downturns. In times of reduced consumer demand for luxury goods, diamond prices may fall, especially for stones that do not have strong rarity factors. Investors should be prepared for potential fluctuations in diamond values and should consider holding onto their diamonds for extended periods to weather short-term price drops.

3. Subjective Valuation

The value of a diamond is highly subjective, and two seemingly similar diamonds can have vastly different prices based on subtle differences in their 4Cs. This subjectivity can make it challenging for novice investors to accurately assess the true value of a diamond, leading to the potential risk of overpaying for a stone or purchasing a diamond with poor resale potential.

To avoid these pitfalls, it’s essential to work with reputable diamond dealers and seek diamonds that come with certification from recognized grading authorities like the GIA. Additionally, consulting with an independent appraiser can help ensure that you are paying a fair price for your investment.

Lab-Grown Diamonds: An Emerging Investment Trend?

Lab-grown diamonds have become increasingly popular in recent years due to their ethical and environmental advantages, as well as their lower price compared to natural diamonds. These diamonds are created in controlled laboratory environments using high-pressure, high-temperature (HPHT) or chemical vapor deposition (CVD) methods, and they have the same chemical and physical properties as natural diamonds.

From an investment perspective, lab-grown diamonds present both opportunities and challenges:

1. Lower Entry Costs

Lab-grown diamonds are significantly less expensive than natural diamonds, often costing 30-40% less for comparable quality. This lower price point makes them more accessible for investors looking to enter the diamond market without spending a fortune.

2. Market Uncertainty

However, the long-term investment potential of lab-grown diamonds is uncertain. Unlike natural diamonds, which are limited in supply, lab-grown diamonds can be produced in unlimited quantities, which could result in downward pressure on prices. Additionally, consumer perceptions of lab-grown diamonds as being less valuable or desirable than natural diamonds may impact their resale value.

While lab-grown diamonds are a great option for consumers looking for affordable and ethical alternatives to natural diamonds, they may not be the best choice for investors seeking long-term returns.

Alternative Diamond Investments: Diamond Funds and ETFs

For those who want exposure to the diamond market without directly purchasing diamonds, there are other ways to invest in diamonds through financial instruments such as diamond funds and exchange-traded funds (ETFs).

1. Diamond Funds

Some investment funds specialize in diamonds, offering investors the opportunity to gain exposure to the diamond market without owning physical stones. These funds typically invest in a portfolio of high-quality diamonds or companies involved in diamond mining, cutting, and trading. Diamond funds can provide a more liquid investment option compared to owning physical diamonds, as they can be traded like other financial assets.

2. Diamond ETFs

While diamond ETFs are still relatively rare compared to gold or silver ETFs, there are some options available for investors interested in the diamond industry. These ETFs invest in companies involved in the diamond supply chain, including mining companies, retailers, and diamond cutters. Investing in a diamond ETF offers a more diversified approach, as it provides exposure to the broader diamond industry rather than the price of individual stones.

Protecting Your Diamond Investment: Storage and Insurance

Once you’ve invested in diamonds, it’s essential to take steps to protect your investment. Proper storage and insurance are key to preserving the value of your diamonds and ensuring they remain secure.

1. Secure Storage

Diamonds are valuable and portable, making them a target for theft. It’s important to store your diamonds in a secure location, such as a safe or a safety deposit box. For high-value diamonds, consider using specialized diamond storage services that offer secure, climate-controlled vaults designed to protect precious gemstones.

2. Insurance

Insuring your diamonds is another critical step in protecting your investment. Comprehensive jewelry insurance will cover your diamonds in the event of loss, theft, or damage. Be sure to have your diamonds appraised regularly to ensure that your insurance coverage reflects their current market value.

Conclusion: Making Smart Choices in Diamond Investment

Investing in diamonds can be a rewarding way to diversify your portfolio, hedge against inflation, and potentially realize significant returns. However, it requires careful research, a thorough understanding of diamond grading, and awareness of market trends and risks. For beginners, focusing on high-quality, certified diamonds with strong rarity factors is a smart strategy, while keeping in mind the long-term nature of diamond investment.

By considering factors such as the 4Cs, certification, market trends, and storage and insurance, you can make informed decisions that maximize the value and security of your diamond investments. As with any investment, patience, due diligence, and expert advice are key to success in the world of diamonds.